Belgian data center market is now picking up

Data centers in Belgium can provide interesting opportunities.

As a result of remote work and the increasing use of cloud storage plus AI, the demand for secure data infrastructure is growing worldwide and expected to explode[1].

SO, WHY BELGIUM?

FLAP reaches its limits. The major data center hubs in Western Europe are located around Frankfurt, London, Amsterdam, Paris (FLAP) and Dublin. Now, FLAP data center growth is limited by the availability of energy (power grid congestion) and to a lesser extend by the impact on water consumption. Belgium is located at the center of FLAP cities.

Belgian data center market is now picking up. CGAR 2023-2028 (measured in IT Power) is forecasted at 18,5%. This year (2024), real estate developer Ghelamco opened in May its first data center near Brussels with a surface of 10,000 sq.m. for the university hospital; Google started in April 2024 the construction of an additional data complex; leading bank KBC started construction of 2 data centers (both near Antwerp) to be operational in 2027; etc.

It is one of the few real estate segments attracting investors. Although real estate is tough nowadays, this does not seem to affect investments in logistics real estate and data centers.

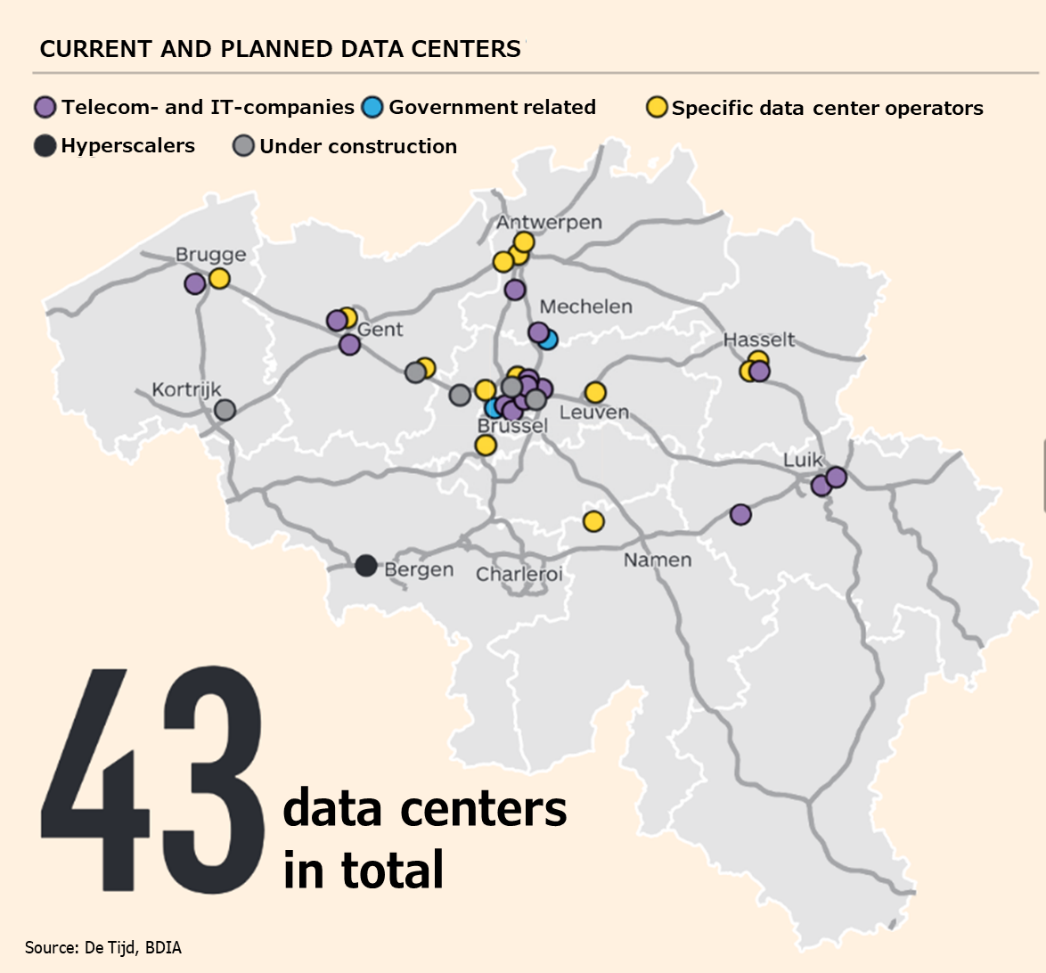

THE MARKET OF DATA CENTERS IN BELGIUM

Data center market comes in four categories:

1) ‘Hyperscalers’ refers to very large-scale complexes built-to-suit for a single technology giant such as Google, Amazon, Meta, Microsoft, Apple.

Belgium is since 2010 home to a Google data center near Mons (Saint-Ghislain) and the center has been expanded several times. The data center counts some 400 employees and will grow to 500 employees. Google’s 2nd data center construction started near Charleroi (Farciennes) and accounts for a total investment of € 1 billion. The total investment of both Google’s data centers in Belgium will reach € 5 billion. Besides that, Google also bought 36 hectares of land near Brussels. Google’s data centers in Belgium serve the European market. Microsoft is currently setting up 3 Azure data centers around Brussels for an investment of € 1 billion. These data centers should support Microsoft’s strategy to the Belgian market.

2) ‘Enterprise’ data centers house the IT equipment from the owner. Some 2.000 Belgian companies, hospitals and government departments operate their data infra on their own sites. And some of these, such as the 3 data centers of the railway operator Infrabel, also lease the unused space to other companies. Although, this still forms the largest group in Belgium, nowadays most companies opt for colocation.

3) ‘Colocation’ data centers rent out data center space on a regional, national or international scale.

The drivers for colocation were covid-19 crisis which led to massive home-based work and the energy crisis. In the meantime, AI and company moves (when a company moves to another location, they often opt for colocation) are extra drivers. Today, Belgium counts some 50 colocation data centers representing a capacity of some 93MW. Note that in the year 2023, Frankfurt alone installed an extra 135 MW. So, today Belgium capacity is still very modest. But some 100MW of colocation data center capacity will be build in the next 5 years.

LCL is the market leader in Belgium with 5 data centers and some 200 clients. LCL will invest € 100 million in 2 data centers in the next 2 years. Datacenter United is a regional player and focuses on SMEs. The company is currently building a new data center in Kortrijk. Digital Realty owns 3 data centers. AtlasEdge, a joint venture between Liberty Global and Digital Bridge operates 1 data center and looks at expansion.

4) Micro data centers are small facilities used by a single tenant or a limited number of multi-tenants. We also recently see some mobile data centers (connected by 5G) to serve temporary needs.

TO WHOM IS THIS OPPORTUNITY FOR?

The opportunities for data center related solutions, products and services are clear (see under solutions and products), though it is also an opportunity for investors.

Besides the fact that data centers is a booming segment, note that data center customers sign long leases (easily 10 years) and the revenue continuously increases because data center customers do not pay per m2 but per kWh (and as data usage is increasing, revenue follows the increase).

Hence, since 2023 Belgium sees foreign infra funds investing in data centers. E.g. Australian Macquarie joined forces with Flemish public investment company PMV to acquire KevlinX and to build a 32MW data center near Brussels; Swedish infra fund EQT builds through EdgeConnex its first data center near Brussels (most likely for Microsoft); Dutch Penta Infra bought Ghelamco’s first and large data center near Brussels; French investment fund Infranity bought Etix Everywhere; etc.

Still, with regards to investments, note that the process of finding and contracting land, power, permits, construction, etc.

takes years and construction is expensive[2] as the centers meet the highest standards, a.o. with regards to humidity and temperature. Locations which already offer data connections are preferred. Brussels is such a location. Still, the area around Brussels will soon also bump into the obstacles which FLAP region already faces. Hence, locations further from Brussels might be more realistic.

Alternatively, it might be more beneficial to take over existing data centers. Currently Datacenter united (75% owned by TINC) as well as Proximus data centers are looking for new owners.

WHAT KIND OF SOLUTIONS OR PRODUCTS ARE NEEDED

Opportunities for racks, cables, servers, etc. are clear but there are also needs for solutions with regard to cooling, humidity, electricity, security, fire and other detection systems.

Lisätietoja / Further details: Embassy of Finland

[1] JLL real estate broker expects worldwide capacity in data centers to rise from 10 ZB (1 ZettaByte is 1,000 billion GigaByte) in 2023 to 21 ZB in 2027.

[2] Construction cost is estimated at some € 10 million/MW, excluding the fiber optic connection (estimated at some € 100,000/km) knowing that data centers are normally connected from 3 to 4 different routes